Join Wyoming Federal Credit Union: Secure and Member-Focused Banking

Join Wyoming Federal Credit Union: Secure and Member-Focused Banking

Blog Article

Join the Movement: Why Federal Cooperative Credit Union Issue

In the realm of monetary establishments, Federal Lending institution attract attention as pillars of community-focused financial, yet their importance extends beyond typical banking services. They represent a standard shift towards member-driven economic options that prioritize inclusivity and mutual development. As we untangle the layers of their effect on neighborhoods and individuals alike, it becomes evident that Federal Lending institution hold the key to an extra flourishing and equitable monetary landscape. Join us as we discover the elaborate tapestry of reasons that Federal Lending institution issue, and uncover exactly how they are shaping the future of monetary empowerment.

Background of Federal Credit Scores Unions

Considering that their beginning, Federal Credit rating Unions have played a pivotal duty in the financial landscape of the United States. The history of Federal Credit score Unions go back to the early 20th century when the Federal Lending Institution Act was signed right into legislation by Head of state Franklin D. Roosevelt in 1934. This Act was a response to the Great Anxiety, intending to promote thriftiness and stop usury by providing budget-friendly credit history to members.

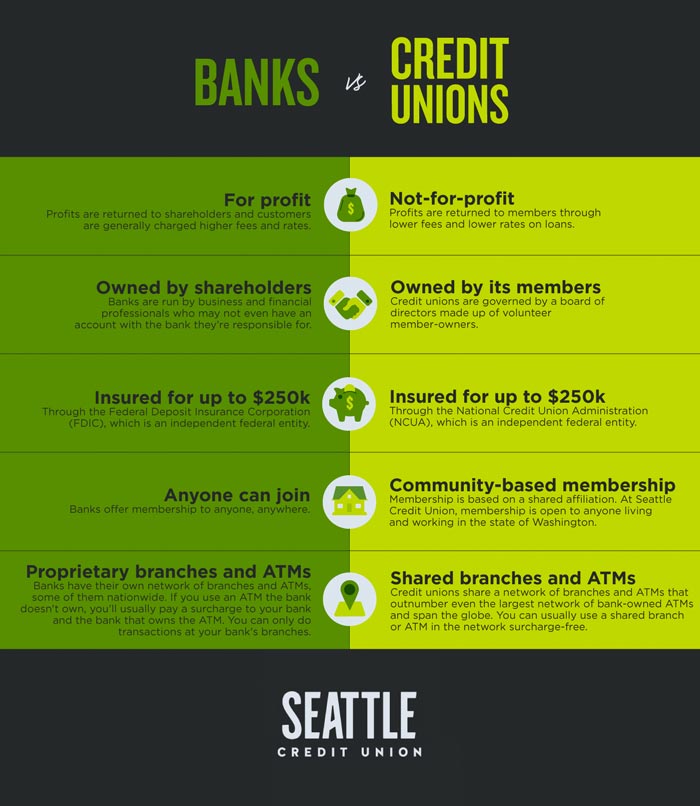

The Act allowed teams of people with a common bond, such as workers of the very same company or participants of an organized labor, to develop lending institution. These cooperative credit union were established as not-for-profit financial cooperatives, had and run by their members. The participating framework enabled people to merge their resources and supply access to inexpensive lendings and other financial services that may not have actually been available to them with standard banks.

For many years, Federal Credit score Unions have continued to expand in number and impact, serving numerous Americans nationwide. They have actually continued to be dedicated to their beginning principles of neighborhood emphasis, participant possession, and financial incorporation.

Unique Services Provided by Cooperative Credit Union

In addition, credit score unions commonly provide lower rate of interest on finances and charge card compared to larger financial establishments. This can cause considerable price savings for participants, especially for those seeking to borrow cash for large acquisitions such as homes or cars and trucks. Additionally, credit scores unions frequently provide higher rates of interest on interest-bearing accounts, allowing participants to expand their money better.

Another one-of-a-kind solution offered by credit unions is profit-sharing. As not-for-profit organizations, debt unions distribute their incomes back to participants in the type of rewards or reduced charges. This cooperative framework promotes a sense of common ownership and neighborhood amongst members, enhancing the notion that credit score unions exist to serve their participants' benefits.

Benefits of Membership in Credit Rating Unions

Signing up with a cooperative credit union offers members a host of concrete advantages that come from the organization's member-focused technique to financial services. Unlike standard financial institutions, cooperative credit union are not-for-profit organizations had and run by their members. This one-of-a-kind framework permits credit rating unions to prioritize the most effective interests of their members most importantly else, leading to numerous advantages for those who pick to sign up with.

Community Effect of Lending Institution

Lending institution play an important role in cultivating financial security and growth within regional neighborhoods with their distinct monetary solutions design. Unlike standard financial institutions, cooperative credit union are member-owned and operated, allowing them to concentrate on serving the ideal passions of their participants as opposed to producing profits for investors. This member-centric technique converts into substantial benefits for the area at large.

One substantial method credit report unions effect neighborhoods is by supplying accessibility to inexpensive financial product or services. Wyoming Federal Credit why not check here Union. From low-interest loans to affordable savings accounts, credit unions supply a vast array of alternatives that assist people and small companies flourish. By reinvesting their incomes back into the community in the form of lower fees, higher rate of interest on down payments, and much better lending terms, cooperative credit union add to the total monetary wellness of their participants

Additionally, cooperative credit union usually prioritize economic education and outreach campaigns, outfitting neighborhood participants with the knowledge and sources needed to make sound monetary choices. By offering financial literacy programs, workshops, and individually therapy, cooperative credit union empower people to attain better monetary self-reliance and safety and security. On the whole, the community impact of lending institution goes past just banking solutions; it encompasses building stronger, a lot more resilient communities.

Future Growth and Trends in Cooperative Credit Union

Amidst developing financial landscapes and shifting customer preferences, the trajectory of credit report unions is poised for vibrant adaptation and innovation. As even more deals relocate to electronic platforms, credit rating unions are enhancing their a fantastic read on-line services to fulfill member expectations for comfort and effectiveness.

Moreover, sustainability and social obligation are arising as crucial fads affecting the development of cooperative credit union. Members are progressively looking for economic institutions that straighten with their worths, driving credit rating unions to incorporate ecological and social initiatives into their procedures (Credit Unions Cheyenne). By prioritizing sustainability methods and neighborhood growth tasks, credit unions can bring in and preserve participants who focus on moral financial techniques

Final Thought

In verdict, federal debt unions play a vital duty in advertising economic stability, community empowerment, and inclusivity. With their unique solutions, member ownership structure, and dedication to reinvesting in the neighborhood, lending institution prioritize the well-being of their participants and add to constructing more powerful communities. As they remain to expand and adjust to altering fads, credit scores unions will certainly stay a crucial pressure beforehand economic freedom for all individuals.

The history of Federal Credit report Unions dates back to the early 20th century when the Federal Credit Scores Union Act was authorized right into regulation by President visit this site Franklin D. Roosevelt in 1934.The Act permitted teams of people with an usual bond, such as employees of the same firm or members of a labor union, to develop credit score unions.Moreover, credit report unions typically offer reduced interest prices on finances and credit score cards compared to bigger financial establishments.Additionally, credit unions commonly focus on economic education and learning and outreach campaigns, furnishing area participants with the understanding and sources required to make sound monetary choices. Through their special services, member possession framework, and dedication to reinvesting in the community, credit history unions prioritize the well-being of their members and contribute to constructing more powerful areas.

Report this page